2025 529 Contribution Limits

Blog2025 529 Contribution Limits. What is a 529 savings plan?. Find each state’s lifetime contribution.

There are no annual contribution limits, but. Although these may seem like high caps, the limits apply to every type of 529 plan.

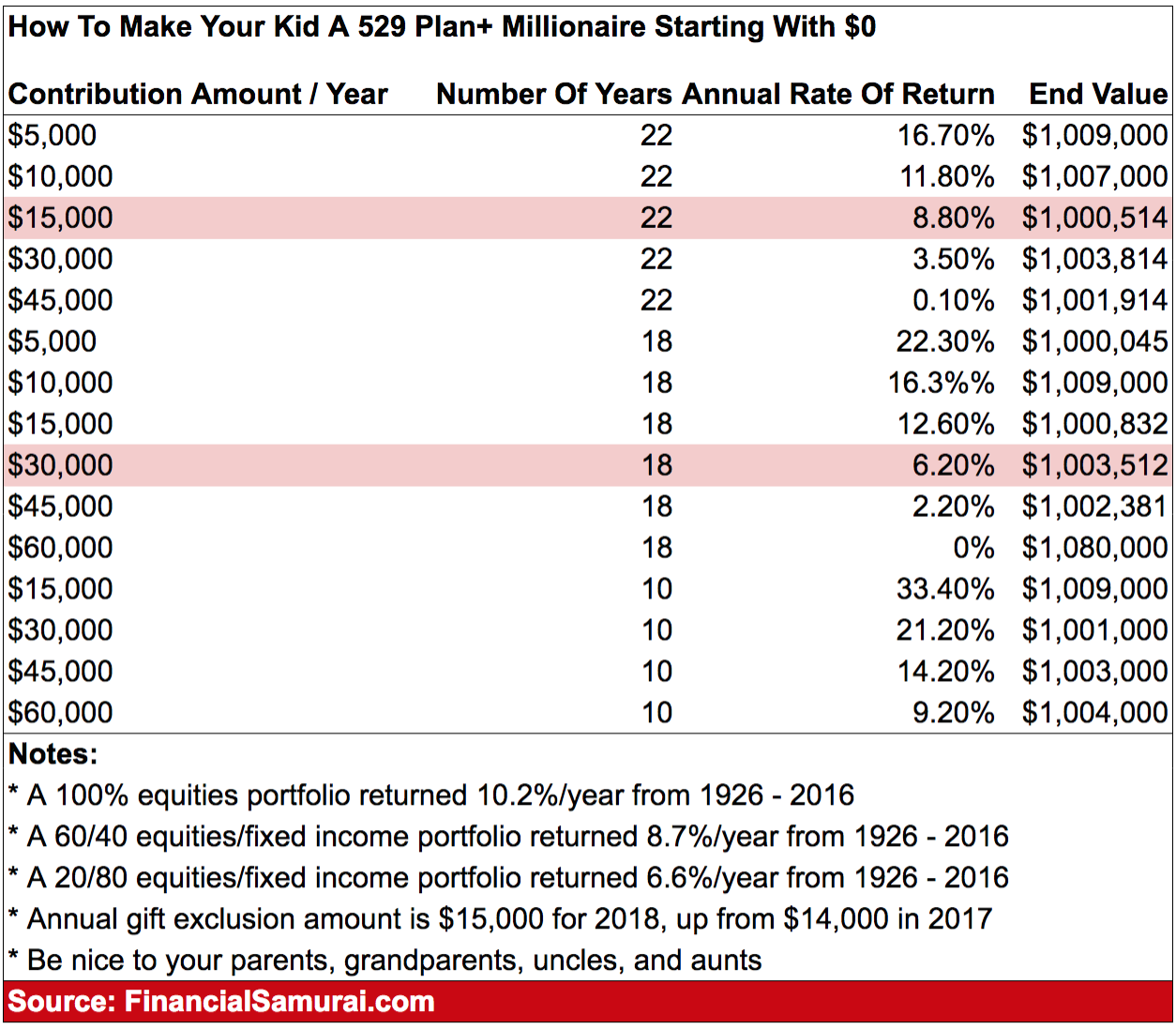

529 Plan Contribution Limits How to plan, 529 plan, 529 college, In 2025, the total contribution limit is projected to be $71,000. Contribution limits for 529 plans vary by state, but they are generally high, often exceeding $300,000 per beneficiary.

What is a 529 Plan Contribution Limit? Finance.Gov.Capital, The total maximum allowable contribution to a defined contribution plan could rise $2,000, going from $69,000 in 2025 to $71,000 in 2025. The maximum contribution for those with eligible plans is $4,300 for.

529 Plan Contribution Limits Limits on annual Royalty Free Stock, What is a 529 savings plan?. In 2025, the total contribution limit is projected to be $71,000.

Ira Contribution Limit 2025 Dorice Robena, Although these may seem like high caps, the limits apply to every type of 529 plan. Maximum aggregate plan contribution limits range from $235,000 to $529,000 (depending on the state), but such limits generally do not apply across states.

529 Coverdell Comparison Charts, The limit is $35,000, as long as the 529 account has been open for at least 15 years. 529 plan aggregate contribution limits by state.

Contribution Limits 2025 Candi Corissa, In most cases, it is possible to fully fund a child’s 529 plan without paying gift taxes. 529 plan aggregate contribution limits by state.

The Tax Benefits and Contribution Limits of a 529 Account YouTube, Although these may seem like high caps, the limits apply to every type of 529 plan. Beginning in 2025, the annual total contribution limits to an ira will be raised to $10,000 for taxpayers between the ages of 60 and 63.

529 Plan Contribution Limits Rise In 2025 YouTube, In 2025, you can contribute up to $18,000 per beneficiary per year before you’d need to file irs form 709. Beneficiaries are allowed to roll over up to $35,000 over their lifetime into a roth ira in their name (not the original 529 account holder’s name).

Irs 529 Contribution Limits 2025 Rory Walliw, Beginning in 2025, the annual total contribution limits to an ira will be raised to $10,000 for taxpayers between the ages of 60 and 63. Annual contributions over $18,000 must be reported to the irs.

529 Plan Contribution Limits For 2025 And 2025, Maximum aggregate plan contribution limits range from $235,000 to $529,000 (depending on the state), but such limits generally do not apply across states. Here’s a look at 529 contribution limits for.

Beginning in 2025, the annual total contribution limits to an ira will be raised to $10,000 for taxpayers between the ages of 60 and 63.